By Harry Clarke | Head of Insights & Analytics

I was delighted to share my charter projections for summer 2024 in the State of the Industry session at this year’s EBACE exhibition. To summarize, we see some fluctuating demand for different regions, with an overall positive trend for June and July within Europe, while demand within the US remains flat.

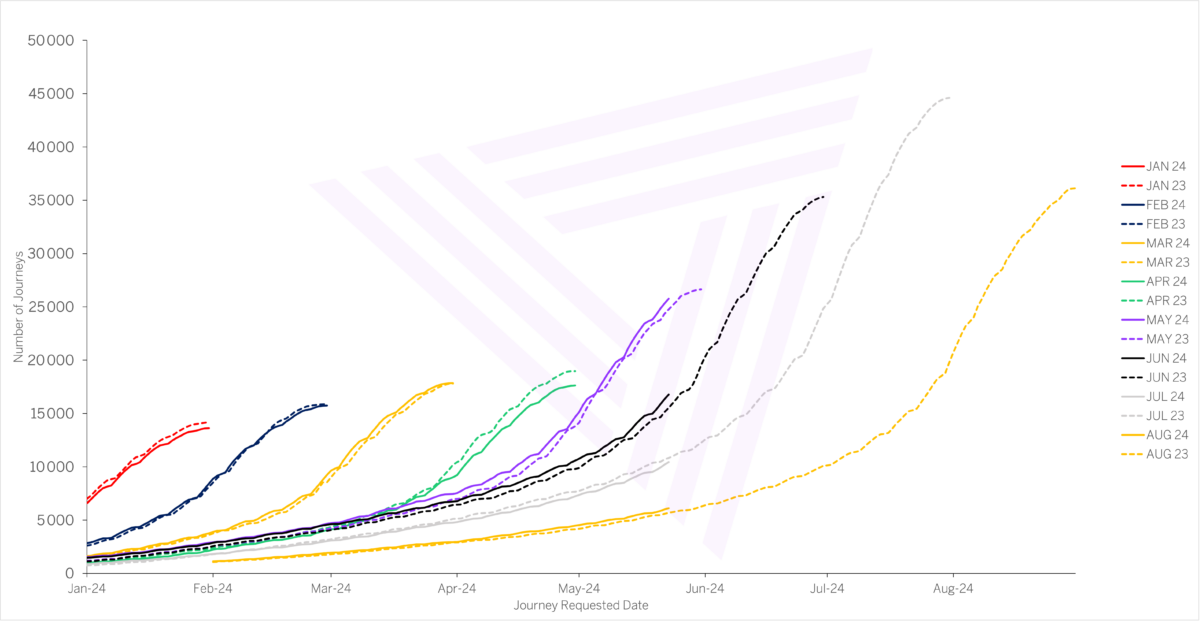

The below chart aggregates demand flowing through the Avinode marketplace by departure month and shows that demand is building as we approach the end of each month. When the solid line is above the dotted line, demand is up year over year.

For demand within Europe, May and June will finish positively compared to the equivalent month last year. July and August track slightly below last year. However, with the majority of the demand to travel in those months still to come, that trend could change.

Summer events driving demand

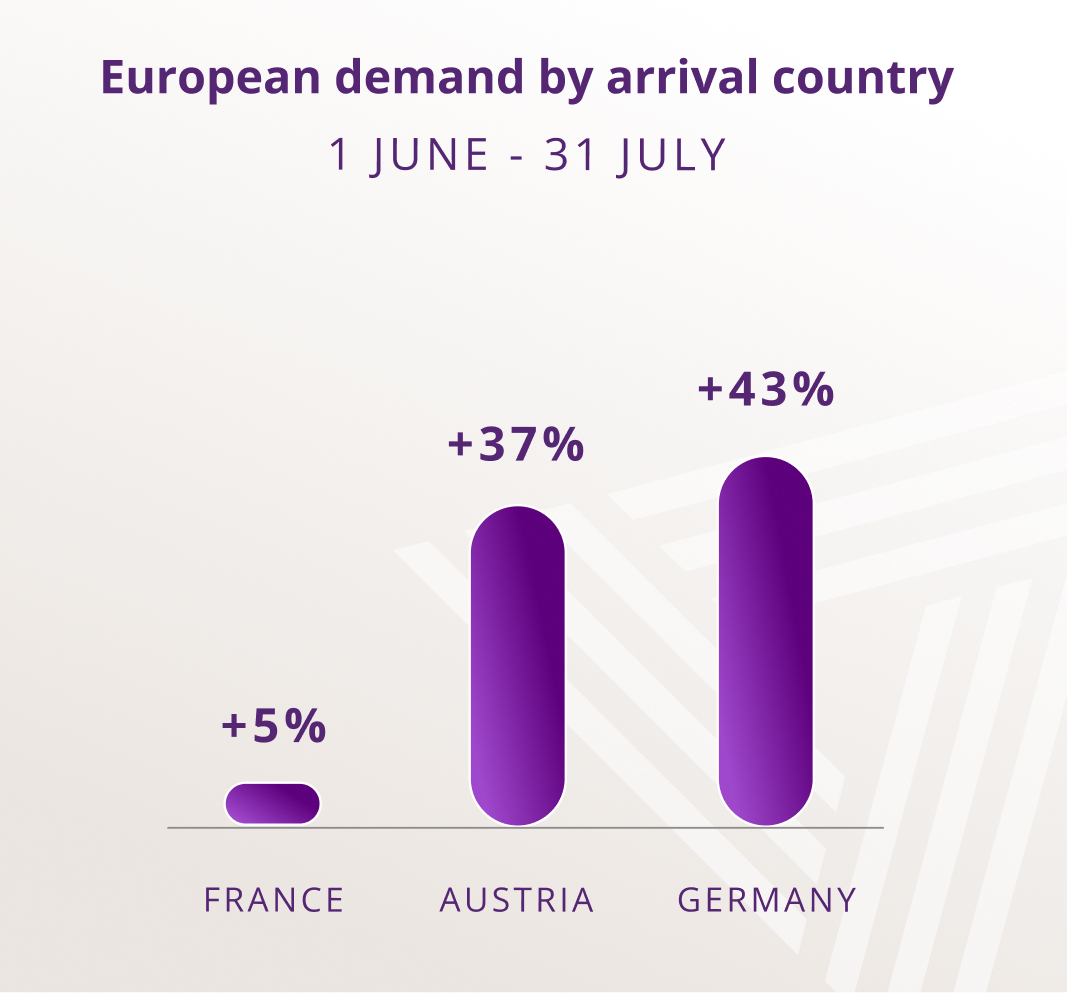

Early demand for Germany as an arrival destination is strong, thanks to the Champions League final featuring a German team and the European Championships throughout June and July.

Summer events, including the Grand Prix, spike demand across the continent. It has been 12 years since the Olympic Games were hosted in a European country, making it hard to predict its impact on air charter demand. In Avinode, we can see that early demand for travel to Paris in late July is a little lower than expected. The majority of the year-over-year increase for this is from the United States.

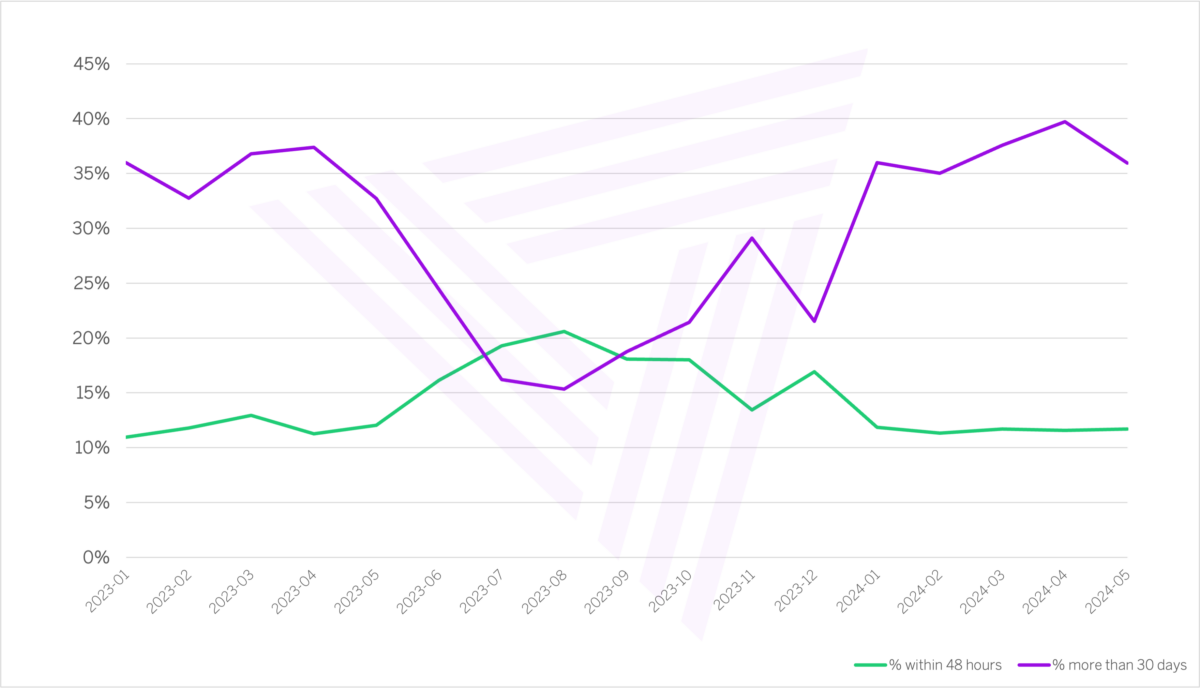

Last-minute demand climbs in the summer months

In May we usually see a dramatic shift in the lead times of charter requests for European travel. In the winter, around 35% of requests are made more than 30 days in advance of a trip and 12% are for trips within 48 hours. In the summer months, these percentages reverse and 20% of requests will be for trips within 48 hours.

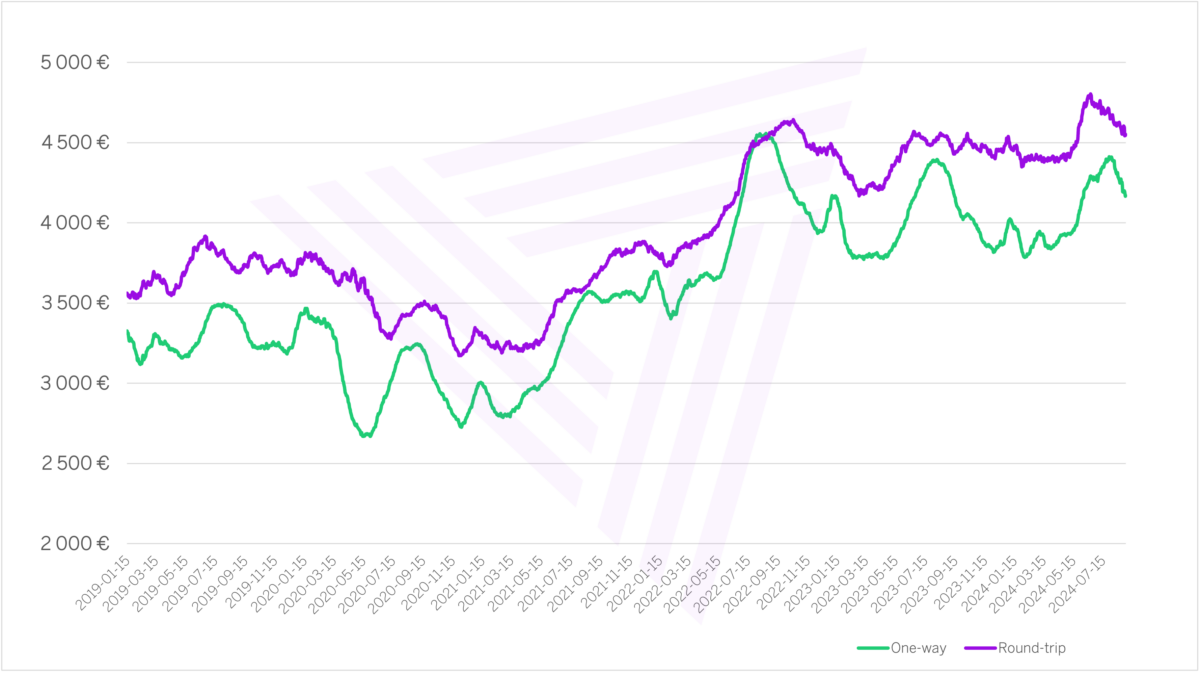

Charter rates remain elevated

Average charter rates within Europe are 20% higher than before the pandemic. While demand has decreased since 2022; charter rates have not. The increase in rates for the summer season is already apparent for 2024. Higher rates aren’t surprising given the cost pressures over the last few years.

This highlights how charter pricing is mostly based on costs with a margin rather than value-based. Seasonal patterns are much more visible for one-way requests, indicating the ability of some operators to better maximize revenue on these types of trips when demand is high.

Taking advantage of demand in a competitive market

Overall, there is less demand for private charter than in the peak years after the pandemic, with airline schedules recovering. However, demand in Avinode remains healthy compared to 2023.

We definitely see more competition for winning trips than before. The share of accepted trip requests was record-high in the United States in January 2024, indicating that brokers have more choices than ever. We’ve also observed that more Avinode operators are optimizing their fleet setup with dynamic pricing and routing rules to take advantage of the demand.

It has been great talking to our members on this topic in Geneva. I’m glad to hear that many of our operators are optimizing their setup in Avinode and ensuring aircraft are marketed effectively. Our Customer Success Managers are always available to help you set up your fleet in the best way!